Taxation

- Services

- Taxation

Taxation

Humans created the State to organize society, and with it came taxation to fund governance. Over time, tax systems have grown increasingly intricate, prompting a push toward simplification.

In today’s challenging economic climate and with the Government’s renewed focus on improving the tax landscape, businesses must reassess their strategies to address evolving tax challenges. Thoughtful tax planning and structuring can help organizations remain competitive in a complex environment while effectively managing their tax liabilities.

While tax laws are the same for everyone, many businesses miss out on tailored advice that aligns with their unique needs. We focus on providing clear and straightforward tax solutions, designed specifically for each client. Our proven methods and collaborative approach ensure efficient, optimized results.

FAQ

UK FAQS

There are several reasons why you may need to submit a tax return in the UK. The most common situations include:

Being self-employed or operating as a sole trader.

Renting out a UK property.

Selling an asset in the UK, such as property or shares.

Serving as a director of a limited company.

Earning over £100,000 annually.

Living abroad part-time or full-time but receiving income from the UK.

Receiving income from foreign sources.

The deadline for filing a self-assessment tax return in the UK is 31st January each year. Failing to file or pay by this date may result in penalties and interest from HMRC. You can begin submitting your tax return on 6th April, the first day of the new tax year. It’s advisable to complete this early to avoid last-minute issues.

The specific documents required depend on the type of income you receive. In general, you’ll need:

Records of all income received during the tax year.

Receipts and invoices for any expenses incurred.

We can provide tailored advice on allowable expenses based on your circumstances.

We operate on a fixed-fee basis, quoted upfront. This means you’ll always know the cost of our services, with no unexpected charges.

No VAT applies, so the quoted fee is the total amount payable.

We do not charge retainers or ongoing fees, and you’ll have access to support throughout the year.

Our fee is typically tax-deductible and can be claimed against rental income, reducing your overall tax liability.

UK residents are entitled to a tax-free personal allowance each year. For the 2021/22 tax year, this amount is £12,570. For capital gains, the first £12,300 of profit is tax-free for the 2021/22 tax year.

If you co-own property, both owners must complete a tax return. HMRC requires each individual to report their share of income or gains, regardless of whether the property is jointly owned or part of a partnership.

You can cease filing tax returns if you no longer meet the criteria for self-assessment, such as after selling a rental property or ceasing self-employment. However, certain tax obligations, like capital gains tax, may only require a one-time return.

All tax owed for a given tax year must be paid by 31st January of the following year. For example, tax for the 2021/22 tax year must be paid by 31st January 2023. If you sell a UK-based property and owe capital gains tax, this must be reported and paid within 60 days of the sale.

If you’ve overpaid tax, either through deductions or payments on account, you may be eligible for a refund. Refund claims can only be made for overpayments going back up to four tax years.

Navigating the UK tax system can be challenging, especially for new residents, landlords, or those with complex tax affairs. A tax agent can:

Ensure you claim all eligible expenses to minimize your tax liability.

Communicate with HMRC on your behalf, utilizing specialist advisor access.

Stay updated on tax law changes to keep your returns compliant. Our experienced team has over a decade of expertise in UK taxation, ensuring you receive accurate advice and support.

If you meet the self-assessment criteria, you must file a tax return even if your business or rental activity operated at a loss. Losses can often be carried forward to offset future profits, potentially reducing future tax liabilities. For rental income, losses can only be used to offset future rental profits and cannot be applied to other types of income.

You’ll typically be invoiced after your tax return has been prepared and sent for your review and approval.

Recent years have brought significant changes for landlords. Key updates include:

From April 2019, non-residents are fully liable for capital gains tax on commercial property sales.

Since April 2020, restrictions on Principal Private Residence Relief (PPR) and the near elimination of Lettings Relief mean higher capital gains tax liabilities for most property owners retaining former homes as rentals.

UAE Direct Taxation

Corporate Tax

The Federal Decree-Law No. (47) of 2022 on the Taxation of Corporations and Businesses (hereinafter referred to as the “Corporate Tax Law”) was issued by the United Arab Emirates (“UAE”), on 09 December 2022.

The Corporate Tax Law provides the legislative basis for the introduction and implementation of a Federal Corporate Tax (“Corporate Tax”) in the UAE and is effective for financial years starting on or after 1 June 2023.

The introduction of Corporate Tax is intended to help the UAE achieve its strategic objectives and accelerate its development and transformation. The certainty of a competitive Corporate Tax regime that adheres to international standards, together with the UAE’s extensive network of double tax treaties, will cement the UAE’s position as a leading jurisdiction for business and investment.

Given the position of the UAE as an international business hub and global financial centre, the UAE Corporate Tax regime builds from best practices globally and incorporates principles that are internationally known and accepted. This ensures that the UAE Corporate Tax regime will be readily understood and is clear in its implications.

UAE FAQS

Companies and other juridical persons that are incorporated or otherwise formed or recognised under the laws of the UAE will automatically be considered a Resident Person for Corporate Tax purposes. This covers juridical persons incorporated in the UAE under either mainland legislation or applicable Free Zone regulations, and would also include juridical persons created by a specific statute (e.g. by a special decree).

Foreign companies and other juridical persons may also be treated as Resident Persons for Corporate Tax purposes where they are effectively managed and controlled in the UAE. This shall be determined with regard to the specific circumstances of the entity and its activities, with a determining factor being where key management and commercial decisions are in substance made.

Natural persons will be subject to Corporate Tax as a “Resident Person” on income from both domestic and foreign sources, but only insofar as such income is derived from a Business or Business Activity conducted by the natural person in the UAE. Any other income earned by a natural person would not be within the scope of Corporate Tax.

Broadly, Corporate Tax applies to the following “Taxable Persons”:

- UAE companies and other juridical persons that are incorporated or effectively managed and controlled in the UAE;

- Natural persons (individuals) who conduct a Business or Business Activity in the UAE as specified in a Cabinet Decision to be issued in due course; and

- Non-resident juridical persons (foreign legal entities) that have a Permanent Establishment in the UAE (which is explained under [Section 8]).

Juridical persons established in a UAE Free Zone are also within the scope of Corporate Tax as “Taxable Persons” and will need to comply with the requirements set out in the Corporate Tax Law. However, a Free Zone Person that meets the conditions to be considered a Qualifying Free Zone Person can benefit from a Corporate Tax rate of 0% on their Qualifying Income (the conditions are included in [Section 14]).

Non-resident persons that do not have a Permanent Establishment in the UAE or that earn UAE sourced income that is not related to their Permanent Establishment may be subject to Withholding Tax (at the rate of 0%). Withholding tax is a form of Corporate Tax collected at source by the payer on behalf of the recipient of the income. Withholding taxes exist in many tax systems and typically apply to the cross-border payment of dividends, interest, royalties and other types of income.

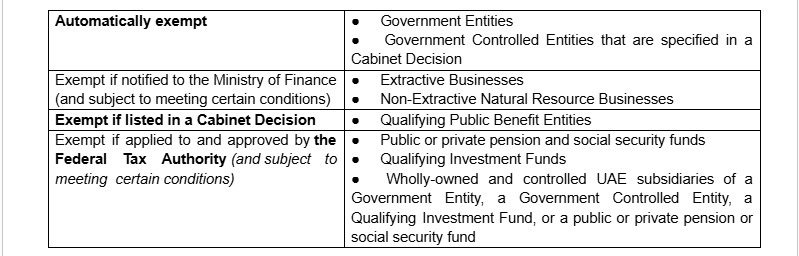

Certain types of businesses or organisations are exempt from Corporate Tax given their importance and contribution to the social fabric and economy of the UAE. These are known as Exempt Persons and include:

In line with the tax regimes of most countries, the Corporate Tax Law taxes income on both a residence and source basis. The applicable basis of taxation depends on the classification of the Taxable Person.

- A “Resident Person” is taxed on income derived from both domestic and foreign sources (i.e. a residence basis).

- A “Non-Resident Person” will be taxed only on income derived from sources within the UAE (i.e. a source basis).

Residence for Corporate Tax purposes is not determined by where a person resides or is domiciled but instead by specific factors that are set out in the Corporate Tax Law. If a Person does not satisfy the conditions for being either a Resident or a Non-Resident person then they will not be a Taxable Person and will not therefore be subject to Corporate Tax.

Companies and other juridical persons that are incorporated or otherwise formed or recognised under the laws of the UAE will automatically be considered a Resident Person for Corporate Tax purposes. This covers juridical persons incorporated in the UAE under either mainland legislation or applicable Free Zone regulations, and would also include juridical persons created by a specific statute (e.g. by a special decree).

Foreign companies and other juridical persons may also be treated as Resident Persons for Corporate Tax purposes where they are effectively managed and controlled in the UAE. This shall be determined with regard to the specific circumstances of the entity and its activities, with a determining factor being where key management and commercial decisions are in substance made.

Natural persons will be subject to Corporate Tax as a “Resident Person” on income from both domestic and foreign sources, but only insofar as such income is derived from a Business or Business Activity conducted by the natural person in the UAE. Any other income earned by a natural person would not be within the scope of Corporate Tax.

Non-Resident Persons are juridical persons who are not Resident Persons and:

- have a Permanent Establishment in the UAE; or

- derive State Sourced Income.

Non-Resident Persons will be subject to Corporate Tax on Taxable Income that is attributable to their Permanent Establishment (which is explained under Section 8).

Certain UAE sourced income of a Non-Resident Person that is not attributable to a Permanent Establishment in the UAE will be subject to Withholding Tax at the rate of 0%.

The concept of Permanent Establishment is an important principle of international tax law used in corporate tax regimes across the world. The main purpose of the Permanent Establishment concept in the UAE Corporate Tax Law is to determine if and when a foreign person has established sufficient presence in the UAE to warrant the business profits of that foreign person to be subject to Corporate Tax.

The definition of Permanent Establishment in the Corporate Tax Law has been designed on the basis of the definition provided in Article 5 of the OECD Model Tax Convention on Income and Capital and the position adopted by the UAE under the Multilateral Instrument to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting. This allows foreign persons to use the relevant Commentary of Article 5 of the OECD Model Tax Convention when assessing whether they have a Permanent Establishment or not in the UAE. This assessment should consider the provisions of any bilateral tax agreement between the country of residence of the Non-Resident Person and the UAE.

Corporate Tax is imposed on Taxable Income earned by a Taxable Person in a Tax Period. Corporate Tax would generally be imposed annually, with the Corporate Tax liability calculated by the Taxable Person on a self-assessment basis. This means that the calculation and payment of Corporate Tax is done through the filing of a Corporate Tax Return with the Federal Tax Authority by the Taxable Person.

The starting point for calculating Taxable Income is the Taxable Person’s accounting income (i.e. net profit or loss before tax) as per their financial statements. The Taxable Person will then need to make certain adjustments to determine their Taxable Income for the relevant Tax Period. For example, adjustments to accounting income may need to be made for income that is exempt from Corporate Tax and for expenditure that is wholly or partially non-deductible for Corporate Tax purposes.

The Corporate Tax Law also exempts certain types of income from Corporate Tax. This means that a Taxable Persons will not be subject to Corporate Tax on such income and cannot claim a deduction for any related expenditure. Taxable Persons who earn exempt income will remain subject to Corporate Tax on their Taxable Income.

The main purpose of certain income being exempt from Corporate Tax is to prevent double taxation on certain types of income. Specifically, dividends and capital gains earned from domestic and foreign shareholdings will generally be exempt from Corporate Tax. Furthermore, a Resident Person can elect, subject to certain conditions, to not take into account income from a foreign Permanent Establishment for UAE Corporate Tax purposes.

In principle, all legitimate business expenses incurred wholly and exclusively for the purposes of deriving Taxable Income will be deductible, although the timing of the deduction may vary for different types of expenses and the accounting method applied. For capital assets, expenditure would generally be recognised by way of depreciation or amortisation deductions over the economic life of the asset or benefit.

Expenditure that has a dual purpose, such as expenses incurred for both personal and business purposes, will need to be apportioned with the relevant portion of the expenditure treated as deductible if incurred wholly and exclusively for the purpose of the taxable person’s business.

Certain expenses which are deductible under general accounting rules may not be fully deductible for Corporate Tax purposes. These will need to be added back to the Accounting Income for the purposes of determining the Taxable Income. Examples of expenditure that is or may not be deductible (partially or in full) include:

Corporate Tax will be levied at a headline rate of 9% on Taxable Income exceeding AED 375,000. Taxable Income below this threshold will be subject to a 0% rate of Corporate Tax.

Corporate Tax will be charged on Taxable Income as follows:

A 0% withholding tax may apply to certain types of UAE sourced income paid to non-residents. Because of the 0% rate, in practice, no withholding tax would be due and there will be no withholding tax related registration and filing obligations for UAE businesses or foreign recipients of UAE sourced income.

Withholding tax does not apply to transactions between UAE resident persons.

A Free Zone Person that is a Qualifying Free Zone Person can benefit from a preferential Corporate Tax rate of 0% on their “Qualifying Income” only.

In order to be considered a Qualifying Free Zone Person, the Free Zone Person must:

- maintain adequate substance in the UAE;

- derive ‘Qualifying Income’;

- not have made an election to be subject to Corporate Tax at the standard rates; and

- comply with the transfer pricing requirements under the Corporate Tax Law.

The Minister may prescribe additional conditions that a Qualifying Free Zone Person must meet.

If a Qualifying Free Zone Person fails to meet any of the conditions, or makes an election to be subject to the regular Corporate Tax regime, they will be subject to the standard rates of Corporate Tax from the beginning of the Tax Period where they failed to meet the conditions.

Two or more Taxable Persons who meet certain conditions (see below) can apply to form a “Tax Group” and be treated as a single Taxable Person for Corporate Tax purposes.

To form a Tax Group, both the parent company and its subsidiaries must be resident juridical persons, have the same Financial Year and prepare their financial statements using the same accounting standards.

Additionally, to form a Tax Group, the parent company must:

- own at least 95% of the share capital of the subsidiary;

- hold at least 95% of the voting rights in the subsidiary; and

- is entitled to at least 95% of the subsidiary’s profits and net assets.

The ownership, rights and entitlement can be held either directly or indirectly through subsidiaries, but a Tax Group cannot include an Exempt Person or Qualifying Free Zone Person.

To determine the Taxable Income of a Tax Group, the parent company must prepare consolidated financial accounts covering each subsidiary that is a member of the Tax Group for the relevant Tax Period. Transactions between the parent company and each group member and transactions between the group members would be eliminated for the purposes of calculating the Taxable Income of the Tax Group.

All Taxable Persons (including Free Zone Persons) will be required to register for Corporate Tax and obtain a Corporate Tax Registration Number. The Federal Tax Authority may also request certain Exempt Persons to register for Corporate Tax. Taxable Persons are required to file a Corporate Tax return for each Tax Period within 9 months from the end of the relevant period. The same deadline would generally apply for the payment of any Corporate Tax due in respect of the Tax Period for which a return is filed. Illustrated below are examples of the registration, filing and payment deadlines associated for Taxable Persons with a Tax Period (Financial Year) ending on 31 May or 31 December (respectively).

India FAQS

E-filing is the process of submitting Income Tax Returns (ITR) online through the official Income Tax portal or other authorized platforms. As mandated by the Income Tax Department, filing tax returns online is the standard method. However, super senior citizens (aged 80 years and above) using Form 1 or Form 4 can still file their returns via paper mode. The process of e-filing can be completed conveniently from your home or office in just a few minutes through platforms like Tax2win or directly on the official Income Tax e-filing website.

Filing an Income Tax Return is mandatory for individuals, including NRIs, whose total gross income exceeds the basic exemption limit. Under the old tax regime, this limit is ₹2.5 lakh, while under the new tax regime, it is ₹3 lakh. For senior citizens (60-80 years), the exemption limit is ₹3 lakh, and for super senior citizens (80+ years), it is ₹5 lakh. Even if your income is below the exemption threshold, you must file an ITR if you meet any of these conditions:

Depositing over ₹1 crore in one or more current accounts.

Spending more than ₹2 lakh on international travel for yourself or someone else.

Paying electricity bills exceeding ₹1 lakh in a year.

Business sales turnover exceeding ₹60 lakh in a year.

Professional gross receipts surpassing ₹10 lakh in a financial year.

Total TDS or TCS amounting to ₹25,000 (₹50,000 for senior citizens).

Depositing ₹50 lakh or more in a savings account during the financial year.

You can file your ITR using:

The Income Tax e-Filing Portal (https://www.incometax.gov.in/iec/foportal/).

Authorized third-party platforms like Tax2win, which allows filing in under 4 minutes with expert support.

The deadline for filing ITR for FY 2023–24 (AY 2024–25) is 31st July 2024.

If you fail to file your ITR by the deadline, you can still file a belated return until 31st December of the assessment year. However, this will attract late fees under Section 234F. Key points about belated returns:

A late fee of ₹5,000 applies if filed before December 31, increasing to ₹10,000 after this date.

Interest at 1% per month is charged on unpaid tax liabilities.

Losses cannot be carried forward if the ITR is belated.

Tax refunds (if applicable) might not be claimable without filing.

Non-compliance may lead to prosecution under Section 276CC, resulting in penalties or imprisonment.

Here’s how you can file your ITR via Tax2win:

Visit the Tax2win website and click on "File ITR Now."

Select your income source and proceed.

Upload Form 16 (if applicable) or manually enter details.

Provide basic details like PAN, Aadhaar, deductions, and bank information.

Review your tax calculation and finalize the process by clicking "File My ITR." You can also file your ITR using the Income Tax Department's e-filing portal.

Follow these steps:

Select “File It Yourself” on Tax2win and upload Form 16.

The software will auto-fill the form using the uploaded data.

Review the computation and make necessary adjustments.

Click “File My Return” to complete the process.

Filing ITR Without Form 16

If Form 16 is unavailable, salary slips, Form 26AS, and AIS/TIS can be used to file your return.

Late Filing Fee:

₹5,000 if filed by December 31 of the assessment year.

₹10,000 if filed later.

Interest on Tax Liability: 1% monthly interest on unpaid tax.

Loss of Benefits: Ineligibility to carry forward losses or claim refunds.

Legal Consequences: Non-compliance may result in fines or imprisonment under Section 276CC.

Once your ITR is filed:

Check your email for an acknowledgment (ITR-V).

Verify the ITR within 30 days (reduced from 120 days since August 2022).

Without verification, the ITR will be considered invalid.

Monitor your refund status if applicable.